Saxo, the online trading and investment specialist, has today published its Q4 2022 Quarterly Outlook for global markets, including trading ideas covering equities, FX, currencies, commodities and bonds, as well as a range of central macro themes impacting client portfolios.

Winter is coming once again for global markets. We are fast approaching a breaking point for the global economy—one that we’ll arrive at due to the “peak hawkishness” from policymakers over the next quarter or so. At Saxo, we have argued since early 2020 that inflation would be deep rooted and persistent. This view still holds, but three factors will lead to the inflationary breaking point. The question facing investor is really this: If we are set for peak hawkishness in Q4, what then comes next?

“Central banks realise that it’s better for them to err on the side of excess hawkishness than continuing to peddle the narrative that inflation is transitory and will remain anchored”, says Steen Jakobsen, Chief Investment Officer at Saxo.

“Second, the US dollar is incredibly strong and reduces global liquidity through the increased import prices of commodities and goods, reducing real growth, and third, the Fed is set to finally achieve the full run-rate of its QT program, which will reduce its bloated balance sheet by up to $95bn per month. This triple whammy of headwinds means that in Q4 we should see an increase in volatility at a minimum, and potentially strong headwinds for bond and equity markets.

“What comes next? The answer is possibly that the market begins to price the anticipation of recession rather than merely adjusting valuation multiples due to higher yields. That turning point to pricing an incoming recession could come in December when the energy prices peak with the above trio.

“It’s estimated the total share of energy in the global economy has risen from 6.5 percent to more than 13 percent. This means a net loss of 6.5 percent GDP. The loss needs to be paid for by an increase in productivity or lower real rates, and lower real rates will need to be maintained to avoid the seizing up of our debt-saturated economies.

“Meaning, there are really two ways this can play out: higher inflation persists well above the policy rate, or yields fall even faster than inflation. Which one will it be? That will be the critical question.”

The bright side: crises drive innovation

This energy crisis will accelerate the green transformation in Europe and create a potential renaissance for Africa but most significantly, it will hasten deglobalisation as the world economy splits in two, with India as the biggest question mark. For the global equity market, there is still some way to go this winter before hitting the bottom, but the brightest days are still ahead of us.

Peter Garnry, Head of Equity Strategy at Saxo, said: “In our Q1 Outlook, we wrote that the global energy sector had the best return expectation with expected returns of 10 percent per annum. Due to rising prices on energy companies this expected annualised return has now fallen to 9 percent, but is still making the oil and gas industry attractive.

“The global energy crisis is grabbing headlines, but the real winter ahead is the deglobalization current which has intensified. There is a picture that the world is splitting into two value systems.

“Globalisation was the biggest driver behind low inflation over the past 30 years and instrumental for emerging markets and their equity markets. Globalisation in reverse will cause turmoil for trade surplus countries, put upward pressure on inflation and threaten the USD as the reserve currency.

“The energy crisis will make Europe the world leader in energy technology, but in the meantime, the continent’s drive to become resource independent of Russia means that Africa must fill the gap, putting Europe in direct longer-term competition with China. In the middle of all of this is India: can the world’s most populous country strike a truly neutral position or will the country be forced to make tough choices?

“The estimated 6.5 percentage point rise in primary energy costs is a tax on economic growth, meaning less disposable income and less operating profits. Consumer discretionary stocks have reacted to this pressure by underperforming relative to the global equity market. The most vulnerable part of the sector is the European consumer discretionary sector dominated by French luxury and German carmakers. Countries such as Germany, China, and South Korea are the most vulnerable to a significant slowdown in consumption and their equity markets have reflected these challenges this year.

Less drama for commodities in Q4

Multiple uncertainties will continue to create a volatile environment for most commodities ahead of the year end. The sector is unlikely to suffer a major setback before picking up speed again during 2023. This forecast for stable to potentially even higher prices will be driven by pockets of strength in key commodities across all three sectors of energy, metals and agriculture. With that in mind, we see the Bloomberg Commodity Index, holding onto its +20 percent YTD gain for the remainder of 2022.

“While we are seeing concerns about growth and demand, the supply of several major commodities remain equally challenged. During Q3, the sector has reasserted itself and while pockets of demand weakness will be visible, we see the supply side equally challenged—developments that support the long-lasting cycle of rising commodity prices that we first wrote about at the start of 2021”, says Ole Hansen, Head of Commodity Strategy at Saxo.

“With global demand for food being relatively constant, the supply side will continue to dictate the overall direction of prices. With global stocks of key food items from wheat and rice to soybeans and corn already under pressure from weather and export restrictions, the risk of further spikes remains a clear and critical danger.

“Precious metal traders and investors will continue to focus on the direction of the dollar and US bond yields. Gold is currently stuck in a wide range, but with the risk of a US recession in 2023 and inflation staying higher for longer, we see gold performing well in such a scenario. These developments will start to add tailwind to precious metal investments in 2023. We favour silver given the current weak investor participation and the additional support from a recovering industrial metal sector where supply, especially for aluminium and zinc, remains challenged by punitively high gas and power prices. The copper-intensive electrification of the world will continue to gather momentum and we are already seeing producers like Chile, the world’s biggest supplier, struggling to meet production targets.

“We view the current weakness in oil fundamentals as temporary and during the final quarter prices are likely to remain challenged at times resulting in a potential lower range in Brent crude between $80 and $100 dollar-per-barrel. Oil majors swamped with cash, and investors in general, showing little appetite for investing in new discoveries suggest that the cost of energy is likely to remain elevated for years to come.”

FX: A Fed thaw needed to deliver a sustained USD turn lower

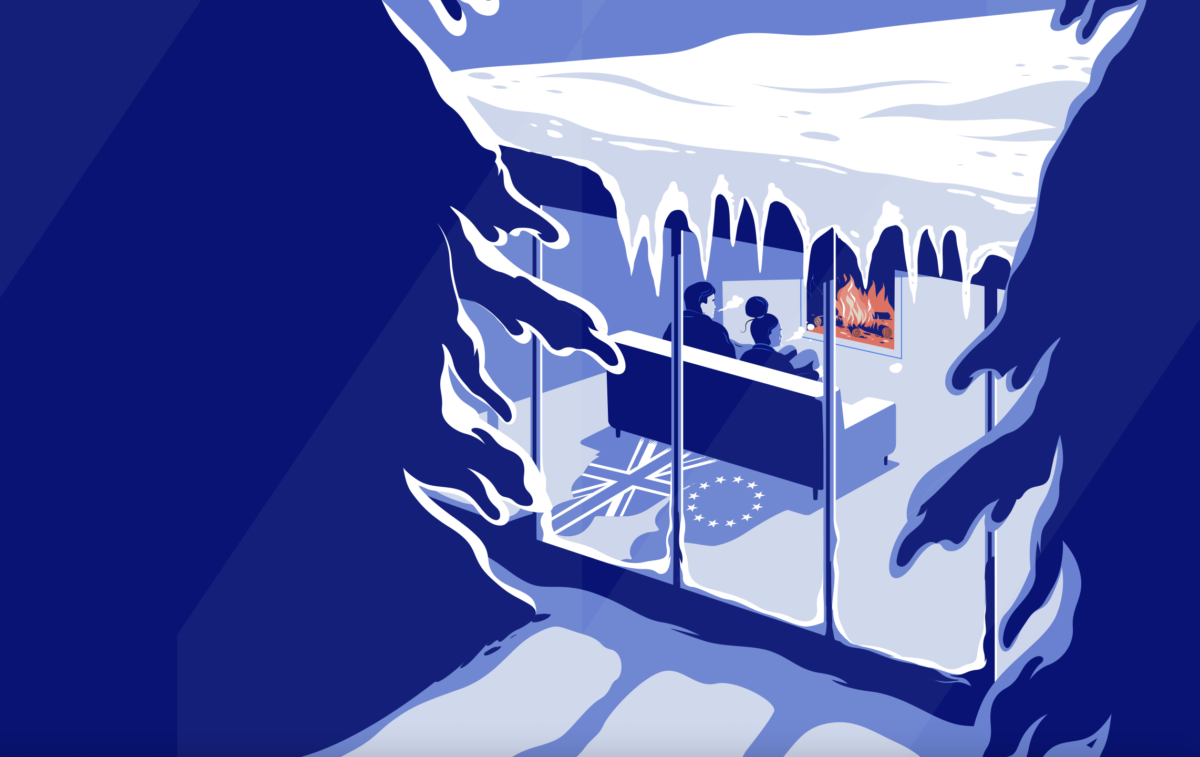

Barring a sudden resumption of Russian natural gas flows in Q4, an economic winter is coming for Europe and the euro, as well as satellite currencies sterling and the Swedish krona. Despite the ECB and other central banks, with notable exception of the Bank of Japan (BoJ), playing some catchup in delivering policy tightening in Q3, the Fed remains the central bank that “rules them all”. We will need to see the Fed easing again before we can be sure that the US dollar is finally set to roll over.

John Hardy, Head of FX Strategy at Saxo, said: “The Fed probably can see now that that it is easier to back down from accidents created by excessively tight policy than to risk aggravating inflation risks with easing financial conditions in the middle of a tightening cycle.

“The US mid-term election are an important tail-risk event for USD in Q4. The US is only able to make policy at the margin on the fiscal side when one party does not control both houses of Congress and the Presidency. If the Democrats surprise and maintain control of the House, it could completely flip the script on fiscal policy.

“Sterling may see an aggravated further drop this winter as long as energy prices remain divergently high for Europe. In CPI-adjusted real-effective-exchange-rate terms, it is only mid-range since the 2016 Brexit referendum collapse.

“In Q3, the CNYJPY exchange rate reached new multi-decade highs well north of 20.00. Could Q4 finally be when something “breaks” here? China might decide that it is simply no longer in its interest to maintain a strong currency, especially if commodity prices begin to fret at the economic outlook souring. But more likely, the capitulation could come from the Bank of Japan via a stronger JPY.

“Will Q4 finally be the quarter that sees the Kuroda BoJ surrender and shift its guidance? There is tremendous two-way volatility potential for JPY crosses, particularly if the USDJPY rips to new aggressive multi-decade highs.

“Regarding CHF, the Swiss National Bank will be happy to continue its tightening policy and encouraging a stronger franc, For the G-10 smalls, the “peak tightness” we anticipate in Q4 will likely not be kind to these less liquid currencies. For the Antipodeans AUD and NZD, we’re curious whether AUDNZD can break above the multi-year range capped by 1.1300 that stretches back over seven years. The Swedish krona looks cheap, but may need to see a major market bottom before its prospects can brighten sustainably.”

Macro: European energy crisis: it will get worse before it gets better

The winter will be tough—there’s no doubt about it. But a recurrence of the ‘Panic of 1837’ and subsequent revolutions across Europe the following year is not inevitable in 2023. There are ways to create solid ground for the energy transition in Europe if we focus on tried and tested solutions around energy efficiency, nuclear power and industrial infrastructures. It’s now up to policymakers to make the right choice.

“History doesn’t repeat itself—but it often rhymes. The current economic period echoes that of the mid-19th century, but there are two major differences: capital is abundant and labour is scarce”, says Christopher Dembik, Head of Macro Analysis at Saxo.

Energy efficiency, the blind spot of the European energy policy. We need to invest in technological innovations, especially artificial intelligence (AI), which could bring quick and concrete benefits to users and lower consumption from this winter onwards. Barcelona’s metro operator has installed an ‘intelligent’ air conditioning system. Energy consumption has been reduced by a stunning 25 percent on average and users’ satisfaction has increased by 10 percent. This will lower energy consumption significantly, not in a matter of years, but within a few weeks of the technology being deployed.

Whether we like it or not, nuclear energy is an integral part of the solution. While most European countries are reluctant to move forward, Asia is embracing it. The prevailing belief that nuclear waste is uniquely dangerous and that the industry does not know what to do with it is false. Nuclear should definitely be an integral part of the energy transition if we ever want to reach a low-carbon economy.

Europe has invested massively into the green transition but there is a missing piece. Namely, Europe’s lack of industrial infrastructure and inability to control the supply chain required for this transition. New passenger cars and vans in the EU will only be sold if they don’t emit any CO2 from 2035 onwards, but who is controlling the mining and processing of critical minerals needed for EV batteries and the green transition? China. Diversification from China’s supply won’t be easy, and it won’t happen overnight. We are repeating the exact same mistake we made with Russia (for fossil energy) and China (for masks and vital drugs during the Covid pandemic).

Cryptocurrencies: The crypto space is getting cold when the hype disappears

The crypto market has been quite dormant over the summer, but the crypto winter is changing the market into a more mature and healthier one. Energy limitations and regulatory developments are raising concerns of future centralization while retail traders watch from the side-lines, but institutions are still in the game and key to showing that cryptos are more than an arena for blockchain enthusiasts and speculative traders.

Anders Nysteen, Senior Quantitative Analyst at Saxo, said: “The decline of Bitcoin prices in 2022 is forcing miners to either relocate to countries with cheaper power or close down their operations. With fewer miners running the network, it will be less secure and may become less decentralised. However, we do not see increased centralization as a major risk within the next couple of years.

“Larger governmental institutions are becoming increasingly concerned with the computationally heavy “proof-of-work” validation scheme which Bitcoin is using. We see a major risk to cryptos if governmental institutions start regulating the use of cryptocurrencies due to their energy consumption. It may limit the number of use cases for cryptocurrencies and thus make it less attractive to employ crypto technology. When the average mining cost for a bitcoin is higher than what the bitcoin can be sold for, the number of miners will likely decrease.

“Speculative traders seem to have disappeared from the crypto space in 2022. Additionally, non-fungible tokens are trading at record-low volumes.

“One bright spot in the crypto winter seems to be the institutional interest, which has not faded in the same way as with retail traders of crypto. During the past couple of months, we have seen multiple bigger institutions investing in the crypto market or expanding their services within digital assets, despite the crypto market rout.

“Cracks are however starting to appear. The number of developers in the crypto space has been declining throughout the past three months but the record-high amount of venture capital which has flown into the crypto space in 2021 and beginning of 2022 can hopefully keep crypto organisations flowing for some time.

“We see applicability as the driver for cryptos going forward, with a probable shift from investments into random crypto tokens and NFTs into crypto technologies with a specific use case. Sony is looking into creating NFT-backed media to give the artists faster and more equitable agreements; GameStop is developing the ownership of digital items in games through NFT technology.”

To access Saxo’s full Q4 2022 Outlook, with more in-depth pieces from our analysts and strategists, please go to: https://www.home.saxo/insights/news-and-research/thought-leadership/quarterly-outlook